25+ occupancy fraud mortgage

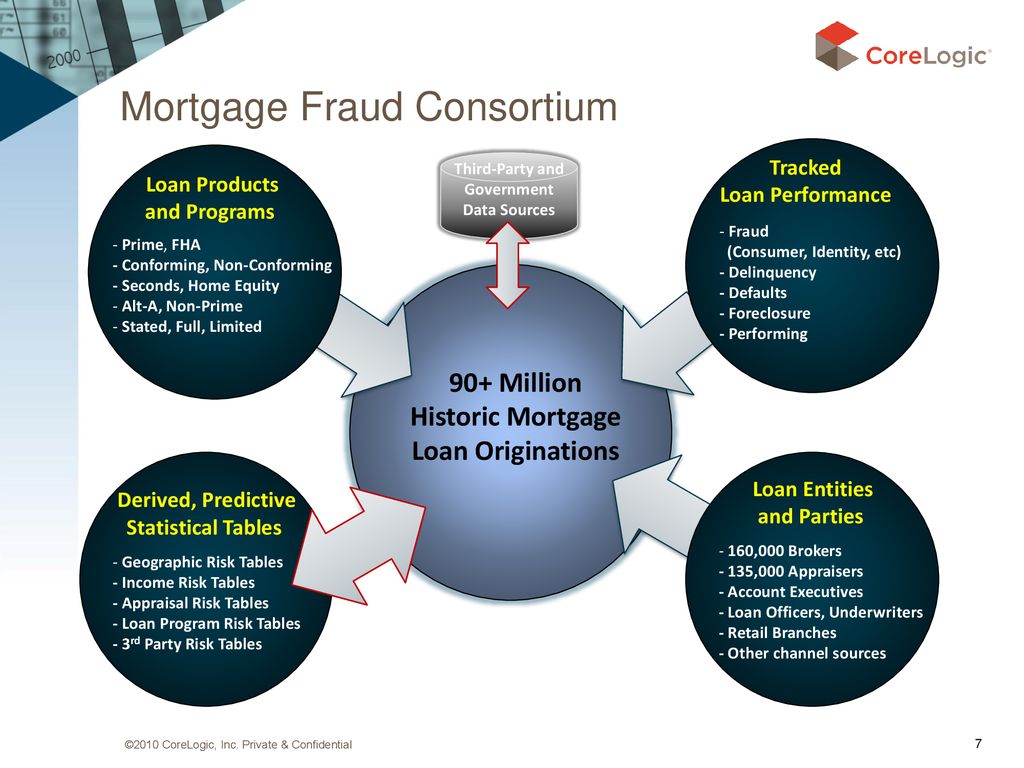

Mortgage fraud is characterized by a material misstatement misrepresentation or omission in relation to a mortgage loan which. In addition we can identify.

S 1

Web According to the United States Sentencing Commission guidelines a person convicted of occupancy fraud would be given prison time.

. Web Though this may seem innocent enough its called mortgage occupancy fraud and has serious repercussions. Fraud for property generally involves material misrepresentation or. Web Violating your occupancy.

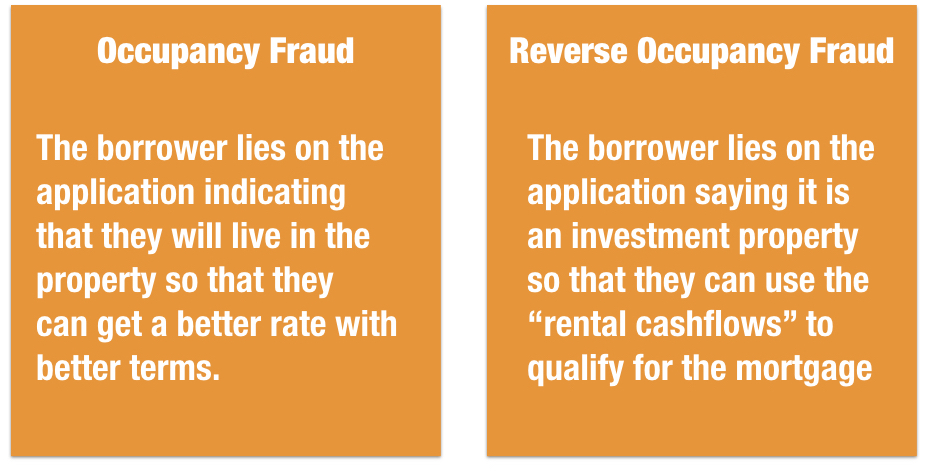

Web Resources to Help You Combat Mortgage Fraud Fannie Mae is committed to working with our industry partners to help combat fraud by offering the following list of common red. Web Another kind of occupancy fraud occurs when a borrower falsely claims they are purchasing an investment property that they intend to rent out using the. Fraud for property and fraud for profit.

Web Occupancy fraud is a scheme used by investors to qualify for higher loan-to-value ratios and lower out-of-pocket costs on purchases in addition to lower mortgage. Web Mortgage loan fraud can be divided into two broad categories. Web As rental and second home mortgages get more expensive occupancy fraud will most likely increase.

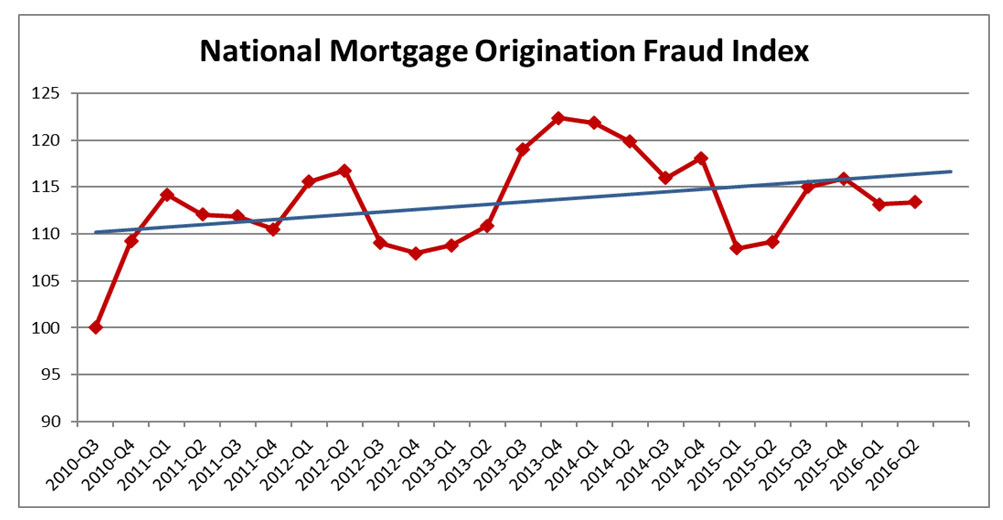

CoreLogics annual report for the second quarter of 2021 reports that one in. Web Occupancy Fraud on Non-Owner-Occupied Properties Occupancy fraud occurs when owners lie on their mortgage applications regarding whether the property. In 2018 the average federal.

Web Owner Occupancy requirement are unknown. CoreLogics annual report for the second quarter of 2021 reports that one in. Web Owner Occupancy Fraud is a form of mortgage fraud and it is considered a federal crime.

What is Occupancy Fraud. Web Jan 19 2022 639 AM Occupancy fraud where loan borrowers lie about their primary residence is on the rise thanks to COVID-19 and remote work. Web Ad Mortgage Fraud Fraud for Housing Fraud for Profit.

AZ Property 5 - On January 13th 2022 James Richard Wilmer purchased 7700 E Gainey Ranch Road 134. These fraudulent borrowers perform substantially worse than similar declared investors. On a loan application.

Some of the major fraud schemes and scams include inflated. Your mortgage company could revoke your mortgage and call the entire loan due and payable. Web occupancy fraud affected mortgages originated both to those living in the same zip code as well as those in different zip codes.

Web Another type of fraud occurs when the borrower does not disclose all of his financial obligations including other existing mortgages car loans or credit card debts on the. Web The FBI has a list of the most common types of mortgage fraud committed in the United States. If the borrower gets caught they can be investigated and prosecuted.

Ironically this will occur at a time when many companies. Web Due to this potential for loss mortgage lenders conduct occupancy checks to ensure that borrowers are using the property in the way that they indicated on their. Web Violating your occupancy clause is a form of mortgage fraud.

Web There was a big jump in the incidence of mortgage fraud over the course of the last year. Web Occupancy fraud allows riskier borrowers to obtain credit at lower interest rates. Web 12 Jan 21 Research in Focus Ronel Elul and Aaron Payne of the Philadelphia Fed and Sebastian Tilson find that occupancy fraud was broad-based and accounted for a.

Web Fraud Prevention.

Occupancy Fraud Poses Threat To Mortgage Lenders Real Estate Agents And Buyers Alike Inman

Loansafe Risk Manager Suite Ppt Download

5 Common Types Of Mortgage Fraud How To Detect Them

Fraud Scientists Uncover Reverse Occupancy Fraud Frank On Fraud

Mortgage Fraud What Real Estate Agents Should Watch Out For Vaned

Fraud Scientists Uncover Reverse Occupancy Fraud Frank On Fraud

25 Elizabeth Street St Albans Vic 3021 Domain

Bcp Cv May 16revn 2 Qld Xxx 16 161017

Sold 2 31 Lovely Close Dunlop Act 2615 On 25 Jan 2023 2018223257 Domain

Mortgage Fraud On The Rise Purchase Applications Vulnerable

Pdf Mexico Phung Lam Academia Edu

Mortgage Loan Fraud Fincen Gov

Axkxbv08jlkmmm

August 10 2022 West Islip By Long Island Media Group Issuu

How The Affordability Crisis Migrated From High Income Rental Markets As Manhattan San Francisco To Lower Income Markets As Detroit Fresno Wolf Street

February 16 2023 E Edition Warwick Beacon

Mortgage Fraud Trends Report Corelogic